How to Make a Simple Budget Using Your Bullet Journal

Taking Time for Financial Self-Care

This is not a blog for finances. I cannot offer specific information about how to invest money, create a magical envelope system, or use a snowball payment system to pay down your debt. However, during the time away from school, I am taking the time, like many of us, to look at my simple budget and make some goals during the school closures. A simple budget is something we all should be doing often. I love using my journal for everyday life. I find that there is something satisfying about having one page be journal writing and the next page to be my monthly budget. Our journals should be living documents of our lives. I like to break down steps and make goals that go into my monthly plans. Financial practices are a form of self-care. I feel like financial self-care is a place that opens a world for us in terms of new learning, growing in good habits, and making goals. In this post, I outline four simple steps to use your journal to create or review a simple budget.

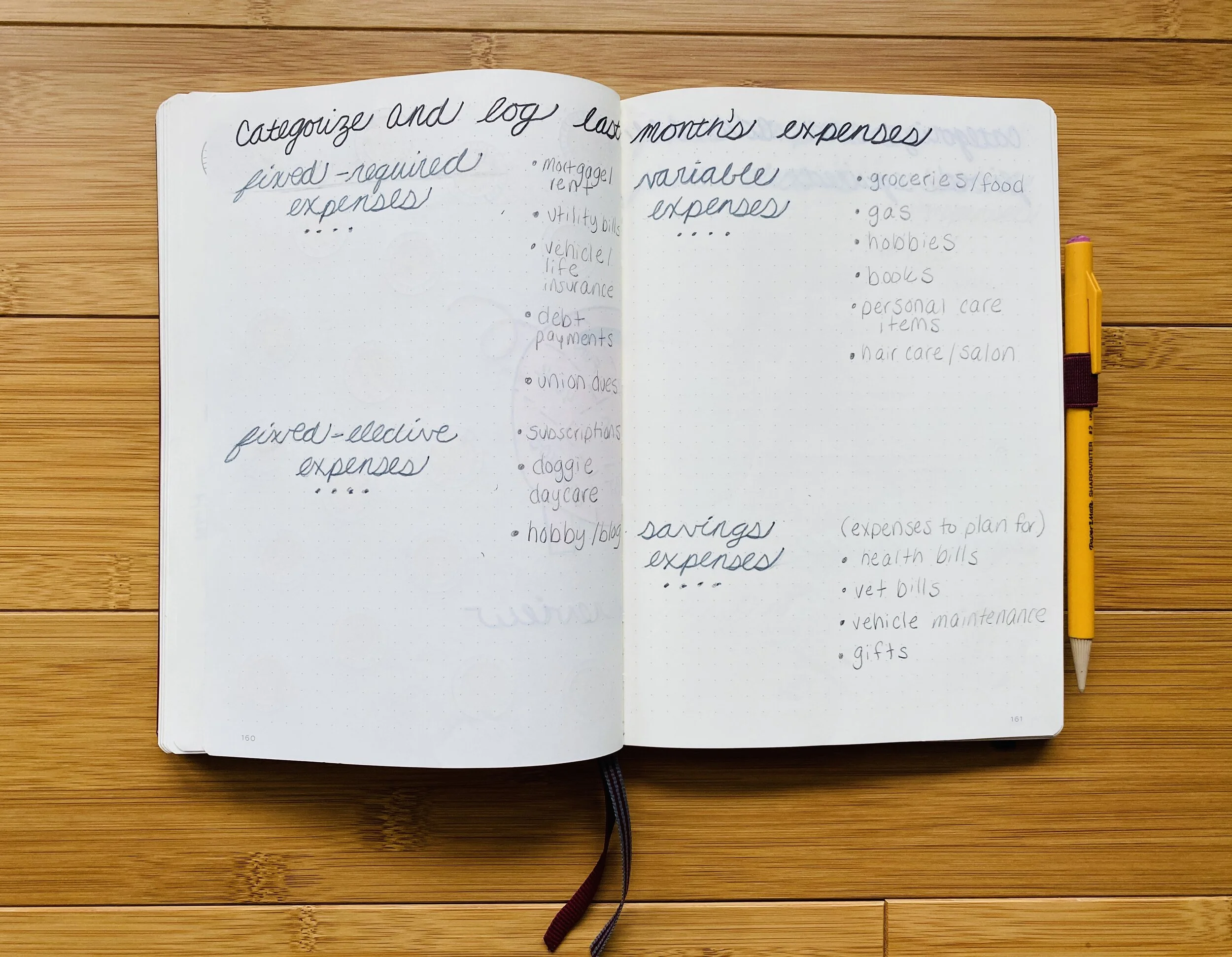

Step 1: Categorize and log last month’s expenses

The first step is always to get real about where your money went…last month. When I do a review, I print out a list of transactions, and I categorize them using these four categories:

Fixed-required expenses: These are bills that are fixed each month, there is a specific due date, and they are required.

Examples: Mortgage, Utility Bills, Vehicle Insurance, Medical Insurance, Debt Repayments, etc

Fixed-elective expenses: These are bills that are fixed each month, there is a specific due date, and they are elective.

Examples: Subscriptions, Doggie Daycare, Hobbies

Variable expenses: These are bills that change from month-to-month.

Examples: Groceries, Gas, Personal Care Items, Hair Care, etc.

Savings expenses: These are expenses to plan for that may come up periodically.

Examples: Health Bills, Vet Bills, Vehicle Maintenance, Gifts, etc.

Step 2: Add all fixed expenses

After you categorize your expenses to see where your money is going, add them all up. This gives you a total of expenses. If you are unhappy with your total, I like to look at my fixed-elective expenses and variable expenses first when I am making revisions, corrections, or goals.

FIXED-REQUIRED + FIXED-ELECTIVE =TOTAL

Step 3: Income and Additional Income Ideas

Income involves two main criteria: 1. ) What money is coming in? and 2.) What additional sources could there be? I am a person who thinks that no matter what profession we are in, we all can diversify the means we have income coming into our pocket. Maybe you have a passion project or a side-hustle that you do after school hours. Perhaps you tutor during the summertime. These ideas can also be things like putting clothes on consignment or filling out online surveys. Take some time to research some ideas that fit into your lifestyle and time available.

MONTHLY INCOME (Write where your current income is coming from)

ADDITIONAL SOURCES (Brainstorm page for adding additional income sources)

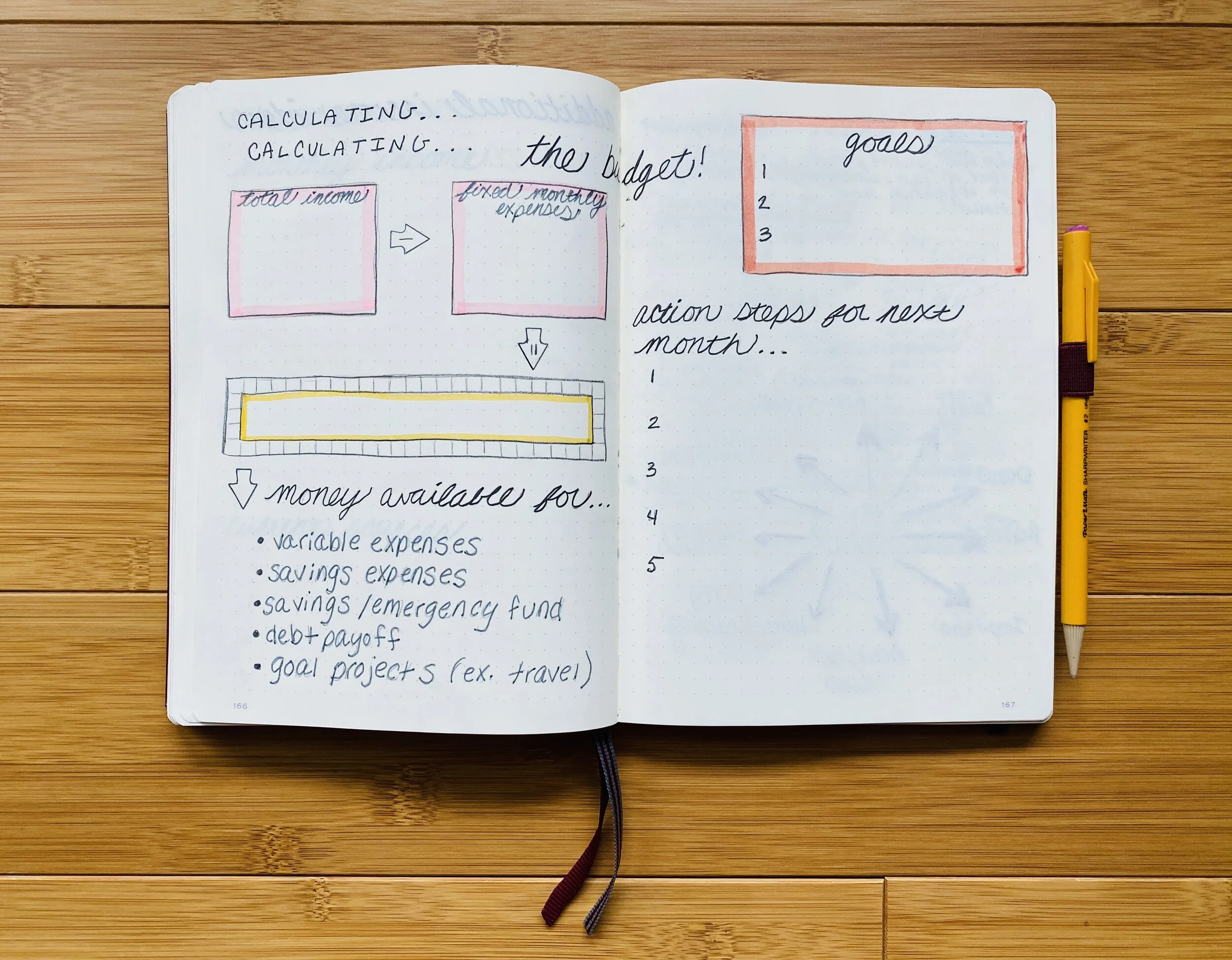

Step 4: Calculating...the budget!

TOTAL INCOME - FIXED EXPENSES =MONEY AVAILABLE

MONEY AVAILABLE:

Variable expenses

Savings expenses

Savings/emergency fund

Debt payoff

Goal projects (travel, hair color, etc)

Goals

I try to keep this number small. I want to focus on a shortlist of goals that I have for each month or quarter so that I can try to make them obtainable. Some examples might be:

Find cheaper alternatives to a fixed-elective expense

Reduce variable expenses spending by $50

Save $75 for ______

Pay $40 more on ____ credit card

Actions Steps Revisited Each Month

Actions steps are the things I see on a month-to-month basis that I can review. A budget is something that should be revisited often. In the past, it has been easy to get into a rut of trying to stick to one outlined budget. However, my variable expenses can change, as well as my savings expenses depending on the time of year. I try to keep these to 4-5 action steps that move over into my monthly plans for the following month. These goals go right next to my other goals for productivity, self-care, and time management.